2017 Tax Reform outline

April 1 is the start of the new fiscal year in Japan and also marks the start of changes in the Japanese tax system that will be relevant for both domestic and foreign businesses operating in Japan. Our outline presented here is primarily focusing on changes with impact for EU SMEs with business activities in Japan.

Main points of 2017 tax reform

Quick links

1. Individual taxes and property tax

(1) Changes to spousal deduction

- Spousal tax deductions will be decreased to stimulate spouses’ participation in the labour market. No deduction if the taxpayer’s income exceeds ¥12.2 million, or if the income of the spouse exceeds ¥2.01 million.

- The upper limit of spousal income for taking the full special spousal tax is increased to ¥1.5 million, gradually decreasing to 0 if the income reaches ¥2.01 million

Sources: MOF (J), E&Y Japan Tax Reform Webcast, March 17, 2017

(2) Establishment of “Reserve NISA (Nippon Individual Savings Account)”

Next to the current NISA, a “Reserve NISA” is established to encourage tax-exempt small and diversified investments for longer periods. Under the new scheme, annual long term investments will be tax exempt for 20 years (instead of 5 year for the existing NISA). Applicable investments are publicly offered stock investment trusts related to a tax account opened during a certain cumulative investment, conducted by agreed investment on a periodic and ongoing basis.

Sources: MOF (J), E&Y Japan Tax Reform Webcast, March 17, 2017

(3) Revision of Fiscal Measures for succession of SMEs

Measure is in place to ensure early and organized succession of businesses as many small and medium business owners are aging and allowed for a grace period for payment of heritance taxes by non-listed companies. Changes this year are meant to make the system more user-friendly:

1. Relaxation of the conditions to secure employment at times of natural disasters

- Companies where the damage to assets is very large,

- Companies where many of the employees are attached to damaged (branch) offices,

- Certain companies where sales have dropped significantly due to clients going out of business due to natural disasters

2. Revision of calculation methods for the conditions to secure employment

Considering small scale business with few employees, round of the fractions of the calculation of the number of employees that ought to be maintained (Number of employees at time of settlement * 80%)

3. Allow dual use with regulations concerning settlement taxes at succession

For stock that are eligible for a grace period of payment of gift tax, make it possible to apply the regulations concerning settlement taxes at succession and make it easier to transfer gifts during life.

Source: MOF (J)

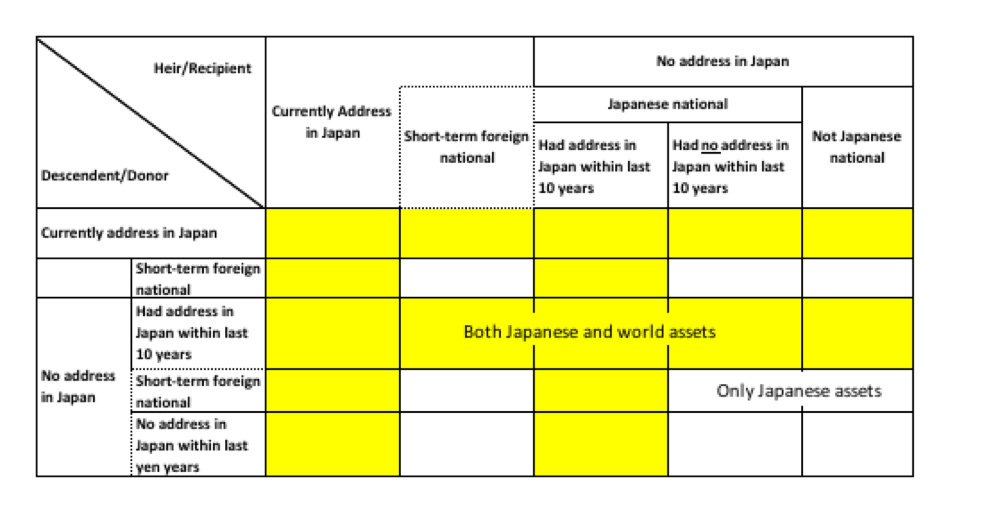

(4) Revision of the scope of tax payment duties of inheritance taxes on foreign assets

The rules with regard to gift and inheritance tax have been revised further and will be more complex due to the introduction of new categories of residents for inheritance and gift tax purposes. The changes for this categories for taxes that were introduced last year were seen as a disincentive for foreign talent to move to Japan, as all assets both domestic and abroad where regarded as taxable. This year’s changes and refinement of rules attempts to rectify this situation and introduce “short-term” residency and “temporary address” categories. A more detailed discussion is provided by an expert from Baker & McKenzie, in their December 2016 Newsletter.

MOF provides a number of concrete examples in its Tax Reform (Proposal) Points leaflet:

|

|

Case where foreign resident with family in Japan passes away and the direct decedents inherit | Japan assets only |

Case where foreign resident in Japan passes away and direct decedents in the country of origin inherit | Japan assets only |

Case where parents of foreign resident in Japan passes away in their country and that foreign resident inherits | Japan assets only |

Source: MOF (J)

Revision of local taxation of high rise residential buildings

Fixed assets taxes and real estate acquisition taxes will be corrected taking the trends of the real value into account for each of the owner’s proportion.

Addition of objects of special measures for fixed asset taxes concerning depreciable assets in local taxation

This measure was taken in the tax reform of last year with a three-year limit and for machinery, certain tools, devices and facilities are added and will fall under this measure.

2. Corporate Tax

(1) Revision of R&D Tax credit

This years’ revisions follow earlier reforms in 2015, when the tax credit limit and “Open Innovation” type R&D credit was broadened. To further provide incentives to increase R&D investments in 2017, the following revisions are made

- Reorganization into system where general tax credit rate (sougakukei) will be 6-14% for large companies and 12-17% for SMEs based upon the increase in the ratio of R&D expenses of the overall sum of tax credits (presently, 8-10%, SMEs 12%) ;

- The credits are maximized to 25% of the amount of corporate tax due in case of regular R&D expenses. This is however further refined where SMEs can add 10%, if increase in spending is larger than 5% and the R&D expenses are more than 10% of the average turnover, where between 0 and 10% can be added. This measure is for two years.

- Costs for R&D for development of new services will also fall under the scheme. These are investments into IoT, AI, Big Data etc., the so-called Industrial Revolution 4.0. For instance:

- Automatic data-gathering with sensors

- Analysis using information analysis technologies by specialists

- New service development

- Coverage of expenses and procedures for special experimental costs (“Open Innovation”) are revised and simplified

At Ernst and Young, an online webcast discussing the changes in R&D tax credits in more detail is available. Other source: MOF (J)

(2) Revision of tax credits to promote increase of salaries

This measure is continued to stimulate companies to structurally increase the salaries of their workers, in order to stimulate national consumption and spur inflation.

For SMEs, in order to be eligible for a 10% tax credit, companies are required to increase the gross salaries of their employees by 2% or 3% compared to the base period and at least 3% for FY 2018 or more than the previous year or the average salary must increase more than the previous year.

An additional bonus tax credit of 12% (was 10%) is given if the average salary increases at least by 2% compared to the previous year.

Example: Company with 20 employees, with average salary of JPY 5 million where regular salary increases are provided. If an increase of JPY 50,000 (less than 2% increase) per employee from the previous year is given, the company can deduct 10% of the difference in salary costs since the base year of its corporate taxation due. In this case if the total increase of salary costs was JPY 4 million, the company can deduct JPY 400,000. If the same company would provide an increase of JPY 350,000 (more than 2% increase) per employee from the previous year, it would be able to deduct not only the 10% of the increases given until the previous year, but also 22% of the additional increase given in the current year. In this case then the salary increase since the base year was JPY 3 million, of which 10% is deductible, the increase of this year, JPY totalling 7 million, would be deductible at 22%, leading to a total tax credit of JPY 1.84 million. |

Sources: SME Agency, FY 2017 Tax Reform leaflet (J), MOF (J), E&Y, PWC

(3) Corporate Governance Reform and arrangements for reorganizations

1) Extension of Filing due date of the corporate tax returns

Currently, there is the requirement that a Japanese corporation must file its corporate tax returns with 2 months. When financial statements cannot be closed due of the requirement to have an external audit, it was possible to apply for a one month extension.

To promote better corporate governance and discussions between corporations and their investors, if companies that have external auditors and cannot hold a shareholders meeting with the three months of the fiscal year end, applying for an extension up to four months is now possible (Six months after the fiscal year-end at the latest). Similar measures will also be taken for local enterprise tax purposes.

2) Fiscal facilities for remuneration of directors

Last year, measures were already taken to allow deductions for restricted stock compensation to support corporate governance reform. This year additional measures are introduced to facilitate performance based director compensation as incentives to create corporate value for mid and long term.

3) Introduction of new reorganization rules: Tax Free Corporate Spin-off

To give more flexibility to corporate reorganisations tax deferral measures are introduced this year. A transaction where a business or subsidiary is separated and transferred to non-controlling shareholders used to be subject to tax, under the new rules a tax qualified spin-off transaction will qualify as a tax deferred transaction. Also, changes are introduced with regard capital gains tax in case of a demerger and treatment of “Squeeze-out” transactions. The measures are scheduled to be implemented from October 1st onwards.

A detailed discussion on this topic is available in the Baker & McKenzie, December 2016 Newsletter and online webinar at Ernst and Young.

(4) Support for Medium and Small size businesses

1) Establishment of fiscal incentives to promote investments for companies designated as “chukaku” companies (Regional Area Core Companies)

If a SME qualifies under the Local Future Investment Enhancement Law as a “chukaku’ company, it can claim special depreciation and tax credits. “Chukaku” companies are those that designated by the government to play a central role in the regional economy, taking the lead in innovation and new business ventures. For machinery and structures, they have invested in they can claim 4% and 2% in tax credits respectively or apply special amortization of 40% and 20% respectively.

Source: MOF(J), METI (on Chukaku companies)(J)

2) Expansion of scope of assets available for special investment tax credit

The measure is expanded to also include investments in equipment and building improvements (fixtures) for the coming two years.

SME management improvement tax programme

Immediate depreciation deduction Tax credit 7 or 10%* | Aimed at capital investment that is based upon an approved plan under the SME Management Enhancement Law - Investments to improve productivity

- Investment to enhance earning capabilities

| |

Special depreciation 30%* or Tax credit 7%* | SME Investment promotion tax programme (Programme where SMEs can apply special depreciation of 30% and 7% of tax credits when acquiring special devices etc.) | Retail and service business Agricultural, Forestry and Fisheries revitalization tax programme (Programme where SMEs running a retail, service or AFF company SMEs can apply special depreciation of 30% and 7% of tax credits when investing in capitail to improve their operations. |

*For enterprises with less than 30 million ¥in capitalization | Investment in automobiles, software, devices, tools (measuring/research), fixtures and furniture | |

Maximum tax credit is 20% of corporate tax amount due.

Example: Company wants to make an investment in buying self-service cash registers for JPY15 million. This would be regarded as an investment to improve operations, it is possible to either choose immediate depreciation deduction, by including it in the business costs or a tax credit of 10% (JPY1.5 million) from the corporate tax due. In case of companies being in the red: It is possible to use the exception for fixed assets tax, where in case of purchases of new capital to improve operations, fix asset tax is halved for three years. In the case of the example, JPY170,000 can be deducted over three years. |

Source: SME Agency, FY 2017 Tax Reform leaflet

3) Limitation of the scope of SMEs eligible for Special Taxation Measures

It will no longer be available if the average taxable income during the past three years exceeds ¥1,500 million. This is due to the capital-based definition of SMEs in Japan, which led to very large multinational companies in financial difficulties, decreasing their capital-base in order to qualify as ‘SME’.

(5) Expansion of regional stronghold strengthening programme

The fiscal measure to stimulate companies to move headquarter functions out of the metropolitan areas and create employment in regional areas is broadened.

Tax credits regarding offices are kept at the current level of 7% in case of moving and 4% in case of strengthening regional offices

The amount of tax credits in case new full-time unlimited employment is generated is raised.

Requirements to usage this programme are relaxed, that it will no longer require that more half the employees are moved outside of Tokyo wards, but instead will include new employees at the new location as well in the calculation.

Source: MOF (J)

3. Consumption tax

(1) Liquor tax reform

With the consumption tax hike postponed to 2019, the biggest change for Japanese consumers in 2017 concerns the decision to harmonize liquor taxes over the coming 10 years. This measure will therefore not impact consumers immediately in FY 2017.

(1) Harmonization of tax rates

- beer and beer-like beverages will eventually fall under one rate in October 2026

- Japanese rice wine and wine will have one rate in October 2023

- Mixers (Chuhai) and low alcoholic drinks tax will be increase in October 2026

The measure means that taxes on traditional beer will decrease, while beer type derivatives such as happoshu will see an increase in taxes.

(2) Revision of definition of beer-type beverages

Also the definitions of the various alcoholic beverages in terms of malt and hop are adjusted

Product | Definition | Tax rate (¥, per 350 ml unit) | ||

| Presently | 2026 | Presently | 2026 |

Beer | Only malt, hop, water and legal materials; Malt ratio ≥67% | Only malt, hop, water and legal materials (partly expanded); Malt ratio ≥50%

| 77 | 54.25 |

Happoshu | Usage of malt | Usage of malt Usage of hop Product similar to other beers | 46.99 | 54.25 |

“New genre” beers and Mixers (chuhai) | Usage of pea protein, hop Mix of happoshu and low-malt spirits Others (Chuhai) | Others (Chushai) | 28.00 | 35.00 |

Source: MOF (J)

(3) Revisions to facilitate regional revitalization

- Establishment of tax exemption measure for traditional Japanese rice wine (sake)

- To promote regions and the value of Japanese sake, sales of locally produced sake (and Japanese wine or local beers) at breweries (wineries) to foreign tourists will be exempt of liquor tax

- Etablishment of shochu special districts

(2) Revision of automobile taxation

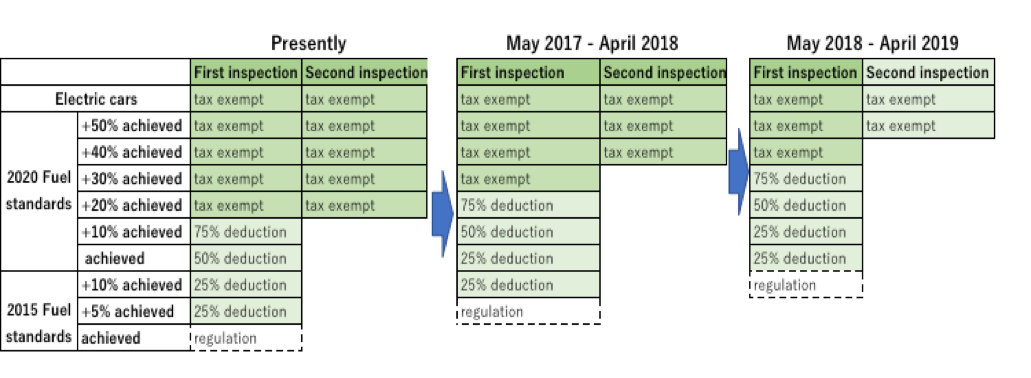

Measure to offer incentives for the spread of more fuel-efficient cars on Japanese roads is continued for another two years, with the thresholds of standards amended and also taking gasoline cars into account. For the coming years the fiscal measures for passenger cars will develop as shown in the table below.

At the regional level, preferential fiscal measures for the eco-cars and fuel efficient cars will be continued for another two years.

Source: MOF (J)

(3) Other measures

(1) Introduction of tax free shops in arrival halls of (air)ports.

(2) Revisions of taxation related to virtual currency

- Transfers of virtual currencies will be treated as non-taxable sales for Japanese consumption taxes.

4. International tax

Revisions to the controlled foreign corporation and “tax haven” rules

Japan has spearheaded the so-called “Base Erosion and Profit Shifting” (BEPS) Project to deal with problems of international tax avoidance and is introducing a number of changes to the Controlled Foreign Companies (CFC) regime. As this is a tax topic which is not likely to be of relevant for EU SMEs, please refer to the following English and Japanese sources for more detailed discussions.